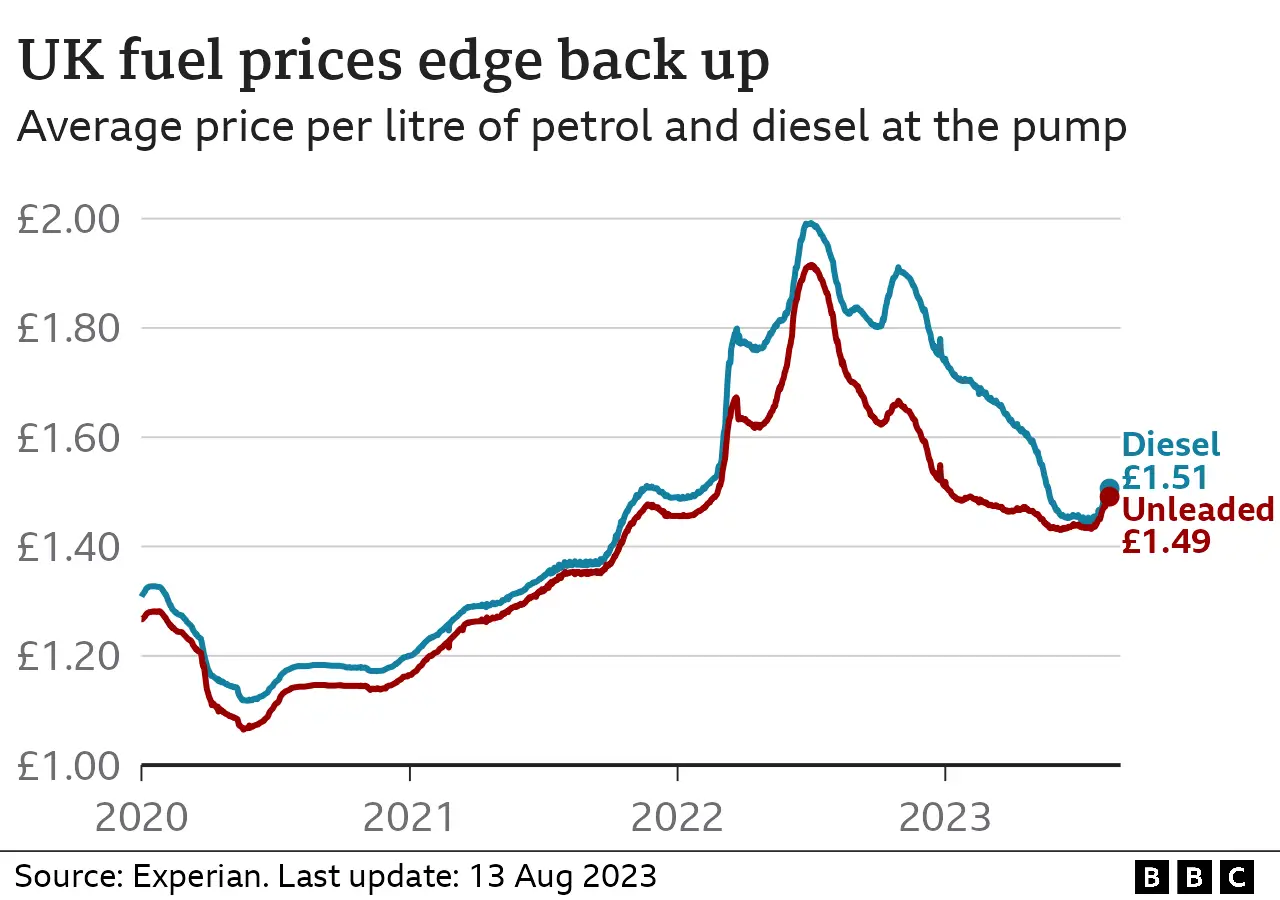

According to the AA, UK fuel prices are on the rise again after a 10-week period of decline, with the average price of petrol at UK forecourts decreasing from 150.1p per litre in late April to 144.5p by the end of June 2024.

Impact of OPEC+ Production Cuts

The recent OPEC+ decision to extend voluntary production cuts of 2.2 million barrels per day into the second quarter of 2024 is expected to significantly tighten the oil market. This move, led by Saudi Arabia’s 1 million bpd cut and Russia’s additional 471,000 bpd reduction, aims to support oil prices amid global growth concerns and increasing non-OPEC production.

As a result, the U.S. Energy Information Administration has increased its forecast for crude oil prices, projecting Brent crude to average $88 per barrel in Q2 2024, $4 higher than previously estimated. However, the impact on prices remains uncertain, as robust global demand growth has been offset by surprisingly strong production outside OPEC+, including increased output from Iran, Libya, Venezuela, and U.S. shale operators.

Regional Price Disparities

Regional price disparities in the UK are significant, with London consistently being the most expensive region. The Office for National Statistics has developed experimental House Price Level (HPL) estimates that show substantial regional differences in housing costs across England and Wales. These disparities extend beyond housing to overall consumer prices.

A study found that London’s consumer price level is 30% higher than the UK average, while regions like the North East, Wales, and Northern Ireland have price levels about 6% below average. These price differences have a substantial impact on relative regional living standards, making inter-regional differences in real incomes considerably smaller than nominal ones.

The cost of living crisis has further exacerbated these regional inequalities, with cities in the North, Midlands, and Wales experiencing higher inflation rates and greater reductions in real wages compared to southern cities.

Historical Price Fluctuations

The UK has experienced significant price fluctuations over the past century, with inflation rates varying widely. Between 1990 and 2020, the price of a typical basket of goods roughly doubled, though individual items showed diverse trends. For instance, while the prices of milk and bread approximately doubled during this period, bananas became cheaper.

The Consumer Price Index (CPI) data reveals substantial inflation in certain years, such as 11.6% in 2022 and 9.7% in 2023. However, there have also been periods of deflation, like in 2009 when prices decreased by 0.5%. The Bank of England aims to maintain a 2% inflation target to support economic stability, a goal it has largely achieved since being given this mandate in 1997.

This long-term perspective highlights the dynamic nature of price changes in the UK economy over time.

Global Supply Chain Effects

The global supply chain crisis has had far-reaching effects on the worldwide economy, with 94% of Fortune 1000 companies experiencing disruptions in their supply chain operations. The crisis has been characterized by chip shortages, port congestion, rising commodity prices, and carrier shortages, leading to production delays and increased costs.

According to a study using satellite data and economic modeling, supply chain disruptions have generated stagflation while increasing producers’ spare capacity and creating scarcity of goods. These disruptions have caused global value-added losses estimated at 26.8% of global GDP, with the spatial extent of the pandemic being the most important driver of global costs.

As a result, many companies are reevaluating their supply chain strategies, including diversifying suppliers, investing in technology for better visibility, and considering nearshoring options to build greater resilience and agility into their operations.

Branded vs Supermarket Fuel

Supermarket fuel from retailers like Tesco, Asda, and Morrisons (see here for Morrisons fuel prices) is generally 3-5p cheaper per liter than branded fuel from companies like Shell and Esso (check Esso fuel prices here). However, all fuel sold in the UK must meet the same British and European quality standards, regardless of the seller.

The main difference lies in the additives used – branded fuels often contain proprietary additive packages designed to enhance engine performance and efficiency. While some drivers report better performance with branded fuels, scientific evidence is inconclusive. Supermarkets often source their fuel from the same refineries as major brands, with the primary distinction being the additive mix.

Ultimately, the choice between supermarket and branded fuel depends on individual vehicle needs and personal preference, as modern cars are designed to run efficiently on standard fuel.

Urban vs Rural Pricing

Rural house prices in the UK have consistently outpaced urban property values in recent years. Between 2018 and 2023, average prices in predominantly rural areas increased by 22%, compared to 17% in predominantly urban areas. This rural premium has reached 18%, with the average rural property costing £347,278 compared to £295,526 for its urban counterpart.

The disparity is even more pronounced in rural villages and hamlets, where average house sale prices were 55% higher than in urban areas (excluding London). Factors contributing to this trend include increased demand for rural properties during the pandemic-driven “race for space”, as well as growing interest in second homes and remote work opportunities in rural settings.

Consumer Spending Impact

Consumer spending in the UK has shown mixed trends in recent months, with overall growth remaining low due to economic pressures. In May 2024, essential card spending grew by 1.6% year-on-year, the lowest growth since August 2023, while non-essential spending increased by just 0.7%, the lowest since February 2021. Consumers have been reducing discretionary spending, particularly on clothing and accessories, in response to rising household bills.

However, there are signs of optimism, with 28% of consumers planning to spend more when the weather improves, especially on food and drink for picnics and outdoor dining. Despite these challenges, UK retail spending has shown some growth, with consumers beginning to invest in treats, experiences, and other discretionary items as economic hopes improve and cost-of-living concerns fade.

Summing Up

The UK fuel market has experienced significant volatility in recent years, influenced by global events and OPEC+ decisions. Petrol prices in the UK have seen fluctuations, with a recent rise following a period of decline. The OPEC+ decision to cut oil production by 2 million barrels per day in late 2022 led to concerns about rising fuel prices and global inflation. This move pushed oil prices above $90 a barrel for the first time since November 2022, potentially leading to higher costs for consumers and businesses.

The impact extends beyond just fuel prices, as increased energy costs can lead to higher production costs for companies, contributing to overall inflationary pressures. These developments have raised fears of prolonged high interest rates and exacerbation of the cost-of-living crisis.